|

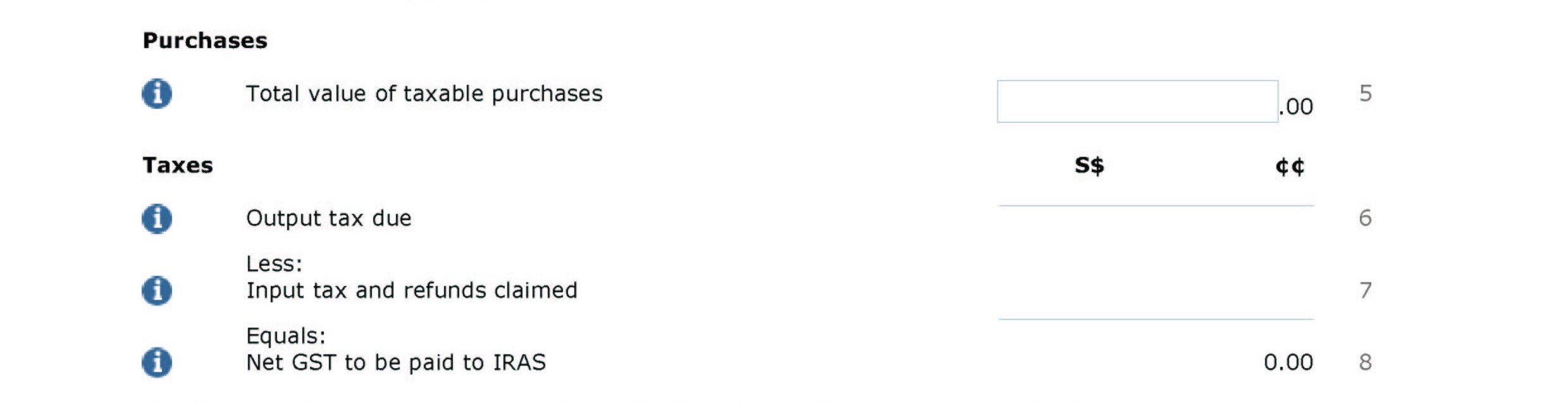

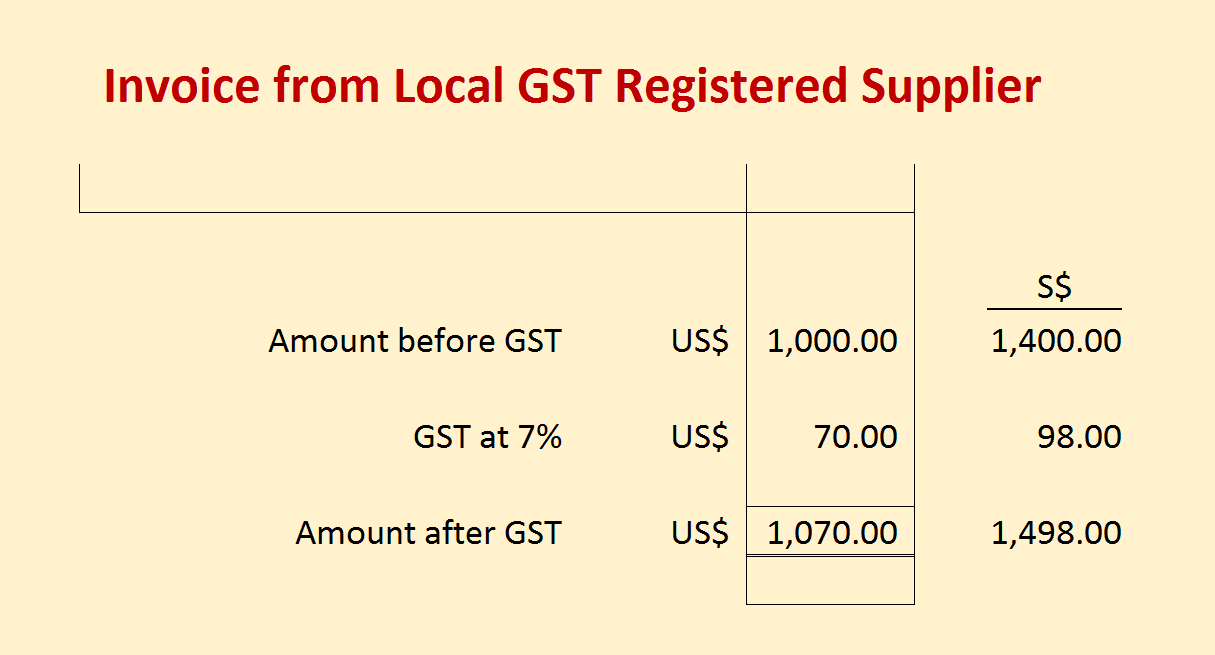

Ask: Is this a local or an overseas supplier? Yes, whenever you receive a supplier invoice denominated in a foreign currency, ask yourself this question. This will help you determine what amounts to report in your GST F5 return under Boxes 5 and 7. Let's break it down. Error 1: Local Supplier - Confusing with the In-house Exchange Rate for AccountingYour supplier may prefer to invoice in a foreign currency even though you've made a local purchase. Should the supplier be GST registered, then the supplier is required by GST regulations to indicate the local SGD equivalence for the invoice amounts based on an acceptable exchange rate. Like this: Here, accounting and GST reporting differ. For accounting purpose, you may ignore the supplier's SGD amounts and use a different rate to record the transaction into SGD. For example, you may record in SGD @ 1.5 as follows: Dr Purchases 1,500 Dr GST Input Tax 105 Cr Accounts Payable 1,605 However, for GST purpose, you should use the supplier's SGD equivalence for declaring the taxable purchases and input tax: Box 5 : 1,400 Box 7 : 98 You can understand the rationale for this approach when you see that the supplier would have reported an output tax based on the SGD amount shown on their invoice. As such, IRAS cannot be made to gain or lose from the same output/input tax. Error 2: Overseas Supplier - Not Following the Import Permit Date and AmountsWhen you import goods, the supplier - being an overseas supplier - does not charge and collect GST on behalf of IRAS. Instead, the customs department collects GST by issuing a document called an import permit when you (or your freight agent) clears the goods. According to IRAS, the timing and value of GST (both input tax and purchase amounts) should then be based on the import permit as follows: Take note of two things here:

(1) The import value calculated by the customs on the import permit generally differs from the supplier invoice because the customs adds extra charges, e.g., insurance and freight, and uses its own published exchange rate to convert to Singapore dollars. (2) The date to declare the GST (both input tax and purchase amounts) is the date of the import permit, not the supplier invoice. For QuickBooks users, learn how to account for import GST in QuickBooks at Qcom's website here. Related: GST Return F5: Can the Value of Revenue (Box 13) Differ from the Total Value of Supplies (Box 4)? Comments are closed.

|

AddBellsUsingSmartEffects

WriterKenny Goh Categories

All

© Copyright 2011-2017

All rights reserved |