GST Return F5: Can the Value of Revenue (Box 13) Differ from the Total Value of Supplies (Box 4)?10/4/2017

Yes. According to IRAS, "the value of your revenue should be extracted from your profit and loss account. It does not have to be aligned with GST reporting." Sounds confusing? Let's break down this statement into 3 situations where differences may arise:

1. Revenue Recognition - Deferred RevenueSuppose you receive the following from your customer:

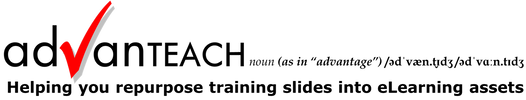

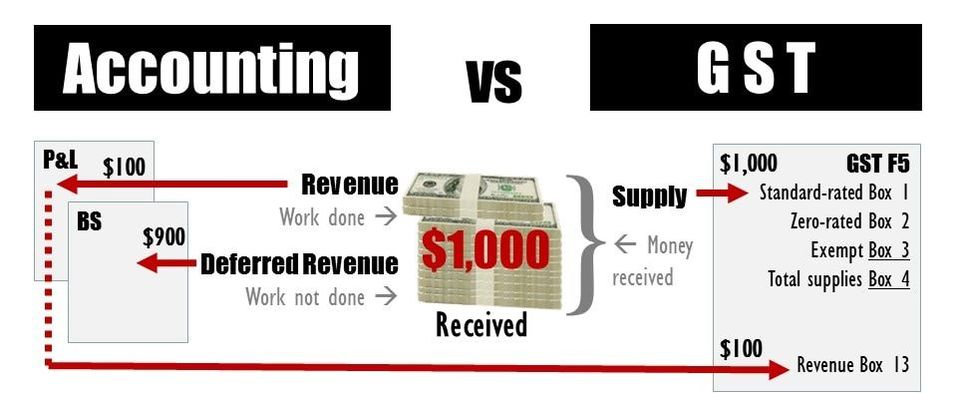

Do you record each as revenue immediately? In general, a business should not record revenue the moment it receives an advance payment from a customer for goods/services that have NOT yet been delivered. Instead, it should first record the receipt (in the balance sheet liability section) as a deferred income before transferring the deferred revenue to revenue (in the profit and loss, "P&L") when the goods/services are delivered. While financial reporting recognises revenue based on the earned/unearned principle, GST reporting recognises supply based on the timing of supply (generally, earlier of money received or invoice issued). Same thing, but different ways of quantifying it. Just like floor level differences in UK and US English. Consider the following scenario (you receive $1,000 upfront from customer): To complicate matters, the difference between accounting revenue and GST supply spills into subsequent periods. Next, let's summarise two other situations that may cause the value of revenue (Box 13) to differ from the total value of supplies (Box 4). 2. Revenue Definition - Non-operating Revenue Subject to GSTIRAS states that the “revenue” to be reported in the GST F5 refers to "the main income source of a business as reflected in its profit and loss account. This generally refers to income received from the provision of services, sale of goods and any other operating income. However, it should exclude non-operating income, such as sale/disposal of fixed assets..." In other words, a gain on sale/disposal of fixed assets - even if reported in the P&L as part of revenue - should not be reported in the GST F5 as revenue. Yet, on the other hand, IRAS requires that when you sell a fixed asset, you are to issue a tax invoice and account for output tax for the sale. This means that the fixed asset sale - even if not related to your trade - is a standard-rated supply (Box 1). In this case, Revenue (Box 13) < Total Supplies (Box 4). 3. Supply Scope - Operating Revenue That is Out-of-scopeOut-of-scope supplies include third country sales (i.e., sales of goods that are delivered from a place outside Singapore to another place outside Singapore), sales of overseas goods made within the Free Trade Zone and Zero GST Warehouses, and private transactions.

GST does not need to be charged on out-of-scope supplies and such supplies need not be reported in the GST return. However, any corresponding operating revenue - even if out-of-scope by GST definition - has to be reported in the GST return. Now, Revenue (Box 13) > Total Supplies (Box 4). What other challenges do you face in reconciling the revenue (Box 13) to the total supplies (Box 4) of the GST F5 return? Related: Two Common GST Errors When You Purchase in Foreign Currency Comments are closed.

|

AddBellsUsingSmartEffects

WriterKenny Goh Categories

All

© Copyright 2011-2017

All rights reserved |