|

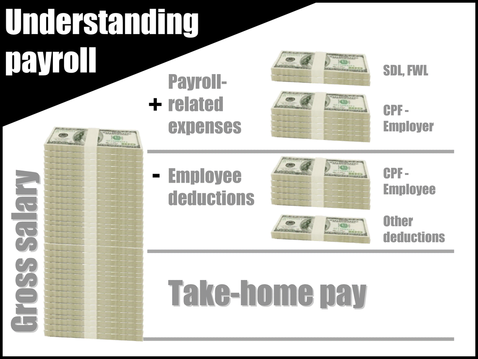

You want your business to grow faster, but reporting requirements are slowing you down. Your're obligated to pay taxes and levies, and government agencies are asking you to round them in different manners. Confused? Here's a quick guide on how to round your taxes and levies. We'll use the statutory CPF (Central Provident Fund) contribution and SDL (Skill Development Levy) as examples later because most businesses need to pay them. Breaking down payroll-related expenses First, let's start with a breakdown of what you need to do before paying your employees. You'll see that you have three things to consider before arriving at the net salary figure, as follows:

SDL and CPF, however, have specific rules to comply with. Before that, you need to know the different rounding methods... This is important: a summary of rounding methods You'll be surprised that the terms used are not universal, so we'll standardise them here:

To understand how SDL and CPF are rounded, we'll need to use the "round (off)/ round up" and "round downwards" methods. How to round SDL? SDL is computed at both the organisational and employee levels. What do I mean? Let's suppose that the SDL rates are stipulated as follows: Every employer shall pay SDL at the rate of 0.25% of the first $4,500 of each of their employees’ monthly remunerations subject to: To calculate your SDL, follow these 3 steps:

So you see, for SDL, you use the normal rounding for each tier. When you get the total, you then drop all cents. How about CPF? CPF is calculated at the employee level only and the rounding is unique for each component: employer CPF, employee CPF, and total CPF. You can get interesting results here... Assuming that the CPF rates are as follows for a particular employee (for illustration only):

Calculate the CPF in 3 steps:

If you use the CPF tables provided by the CPF Board, the amounts are already properly rounded. Do not be surprised, therefore, if you find the rounding for your employer CPF "out" by a dollar, as demonstrated above. Conclusion - use your knowledge for other statutory obligations Even if you do not manually calculate your payroll and related liabilities, understanding the rounding principles makes you more confident when you read government regulations on various employer obligations. Consult your accountant and tax agent for clarifications. Your homework: Now, let's look at a topic not related to payroll. Read this letter by IRAS (Inland Revenue Authority of Singapore) on GST (Goods and Services Tax) rounding: GST on receipts are allowed to be rounded off to a whole cent Is it easier now to understand IRAS' message? A.B.U.S.E. Takeaway for QuickBooks Users If you do not use the QuickBooks payroll module - which is designed for Canada or Australia businesses, depending on the country version that you're using - then you need to record your payroll in two steps:

1.1 Journal - accrue for each employee's salary (one journal per employee)

Notes:

1.2 Journal - accrue for levies at the company level

2.1 Write cheque - pay salary for each employee (one cheque per employee)

2.2 Write cheque - pay CPF Board as a lump sum

Comments are closed.

|

AddBellsUsingSmartEffects

WriterKenny Goh Categories

All

© Copyright 2011-2017

All rights reserved |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||